In the landscape where LiDAR technology is becoming the established norm for powering self-driving vehicles, a fledgling startup named Altos Radar has emerged to challenge the supremacy of light-based remote sensing technology by introducing 4D millimeter wave radar.

Hailing from California and established in January, Altos Radar recently secured its initial funding round of $3.5 million from investors including ZhenFund, Monad Ventures, and Yifan Li. The involvement of Li, the CEO and founder of Hesai, a prominent LiDAR manufacturer that achieved a $190 million IPO in February, might appear unexpected initially, given the ongoing competition between radar and LiDAR for dominance in the autonomous vehicle market. Yet, upon closer examination, this investment hints at an intriguing new development in the field of automotive perception.

LiDAR, which employs light for measuring object distances, currently boasts greater robustness compared to radar when it comes to delivering high-resolution, three-dimensional mapping. However, there’s a trade-off: top-tier LiDAR sensors often come with hefty price tags in the tens of thousands of dollars, though Chinese manufacturers such as Livox affiliated with DJI and RoboSense have significantly lowered these costs.

Altos Radar’s Co-founder and CEO, Li Niu, firmly believes that millimeter wave radar is progressing at a rate that positions it as a compelling alternative to LiDAR, particularly in advanced driver assistance systems (ADAS) and potentially even fully autonomous driving scenarios.

“Lidar gained prominence with the rise of autonomous driving. During the initial developmental phase, companies prioritized maximizing sensor capabilities at any cost. However, as we enter the latter phase of competition, the focus is shifting towards generating tangible value,” Niu proposed.

According to Niu, Altos’s automotive radar outperforms LiDAR in various aspects. Firstly, it boasts a sensing range of 350 meters, surpassing that of most LiDAR products, which proves beneficial for highway driving. Additionally, its functionality remains intact across diverse weather conditions due to radar’s capacity to penetrate objects. Notably, Altos has the capability to instantaneously and accurately measure speeds as low as 0.2 meters per second, a crucial factor in predicting a vehicle’s trajectory, as emphasized by Niu. Furthermore, the radar’s sensors exhibit the ability to differentiate objects even when they are as close as 0.31 meters apart.

While some of these attributes are typical of radar technology and not exclusive to Altos, Niu highlighted that these capabilities can be enhanced. He acknowledged that these are “design choices,” and the enhancement of some aspects might compromise capabilities in others. Given these favorable radar features, coupled with its affordability at a fraction of LiDAR’s cost, one might wonder why radar hasn’t been widely adopted in autonomous vehicles (AVs). Niu pointed out that the adoption has been hindered by the recent emergence of the 77GHz band, a standard for automotive radars introduced only in 2017. Existing radar systems with limited resolution have primarily played a “supporting role” by providing velocity data.

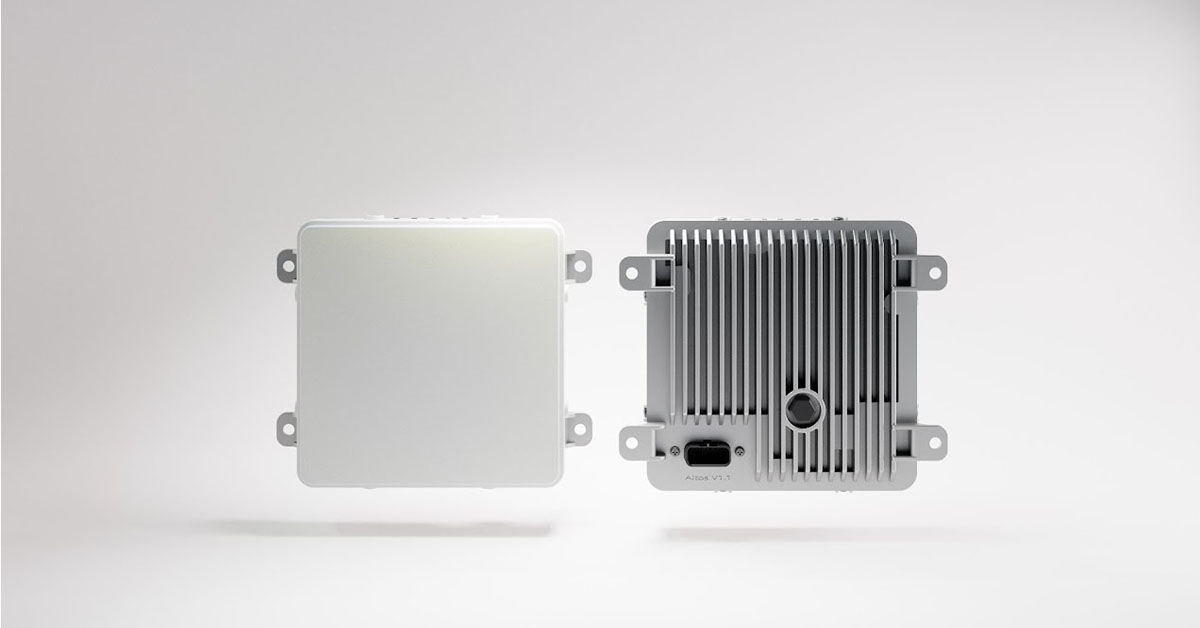

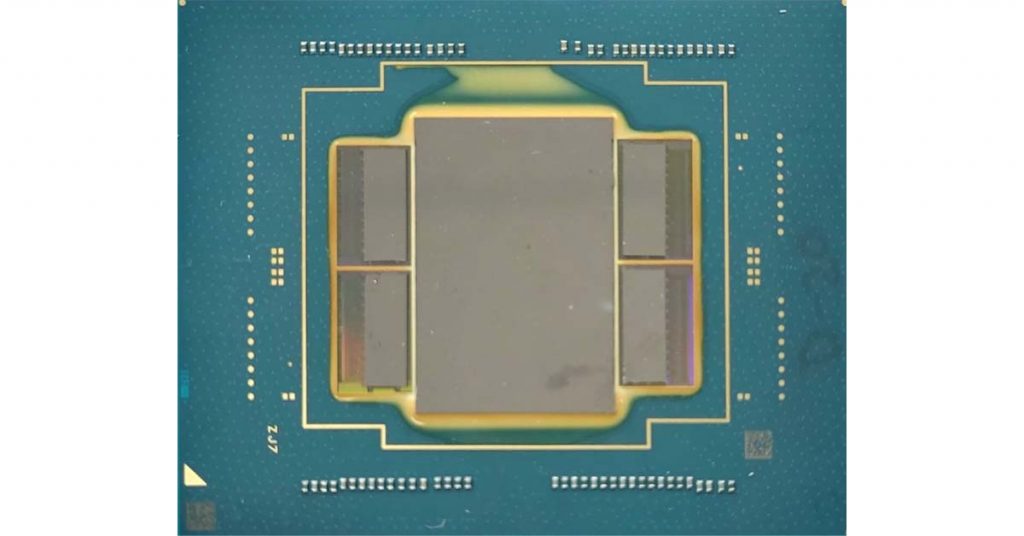

Altos, however, intends to stand out. In a prerecorded demonstration, Niu showcased how the startup’s radar generates real-time, high-resolution “point cloud” data, a distinctive capability historically associated with LiDAR. According to Niu, this is where Altos truly differentiates itself. Although major Tier-1 manufacturers have been developing high-resolution radar solutions, Niu contended that most of these solutions are not yet production-ready due to their reliance on field programmable gate arrays (FPGAs) as processors, requiring complex programming and substantial computing power.

In contrast, Altos employs application-specific integrated circuits (ASICs), which are purpose-optimized, leading to reduced costs and power consumption. Niu described this approach as “compute optimization,” explaining that the sensors can extract significantly more computing power from the same chip. Specifically, Altos claims to achieve 80 times the performance of an ASIC’s reference radar design.

When considering Altos in relation to cameras, which Elon Musk famously touted as the future of autonomous vehicle perception, Niu highlighted that radar consumes notably less computing power since it selectively transmits valuable information. Additionally, radar provides the added advantage of measuring distance and speed, which is not a feature of cameras. Musk had ordered the removal of radars from Tesla vehicles in 2021 due to dissatisfaction with their quality at the time. However, he maintained his belief in the potential of “higher definition radars” to enhance Autopilot and Full Self-Driving, as he mentioned in an interview with Electrek in February.

Software vs. hardware

Niu contended that his startup’s additional strength lies in the expertise of his team. During his time at Apple, he was among the initial 150 employees dedicated to developing the company’s autonomous system hardware from scratch. Subsequently, at Pony.ai, a Toyota-backed venture in the realm of robotaxis with offices in China and the U.S., Niu led the internal radar and camera team.

Michael Wu, another co-founder, draws from his prior role as a mobile platform engineer at Mozilla, where his specialization involved optimizing browser performance on end devices. Also a former member of Pony.ai, his current primary responsibility is to ensure that Altos’s solution remains free from software delays within vehicles.

These collective experiences empower Altos to navigate the intricate crossroads of software and hardware, as highlighted by Niu. He remarked, “In the context of software and hardware, there have historically been two approaches. One is exemplified by Apple, which concurrently develops hardware and software; the other is represented by Android, which concentrates on software and delegates hardware to original equipment manufacturers (OEMs). Tesla can be likened to the modern-day Apple. It’s challenging to definitively determine which approach is superior, but I personally believe that the most exceptional companies engage in both.”

Niu added, “In fact, hardware production is the less daunting aspect. Our competitive edge lies in our research and development, as well as our software design.”

Altos’s radar products are poised for shipment, and the startup has commenced initial discussions with numerous clients, spanning original equipment manufacturers, self-driving entities, universities, and port facilities, both in the United States and China.

However, despite possessing a well-rounded team and a seemingly competitive product, Altos confronts several forthcoming challenges. Entering an already well-established industry with an intricate and extensive supply chain is no small feat. The startup’s triumph also hinges on the cooperation of multiple stakeholders throughout the value chain.

Niu noted, “Our precise customers are not the OEMs themselves, but rather the autonomous vehicle divisions within these OEMs. Our primary hurdle will be whether these autonomous vehicle teams can efficiently deliver value to their end users and effectively harness the potential of millimeter wave radar, a field that few are acquainted with.”