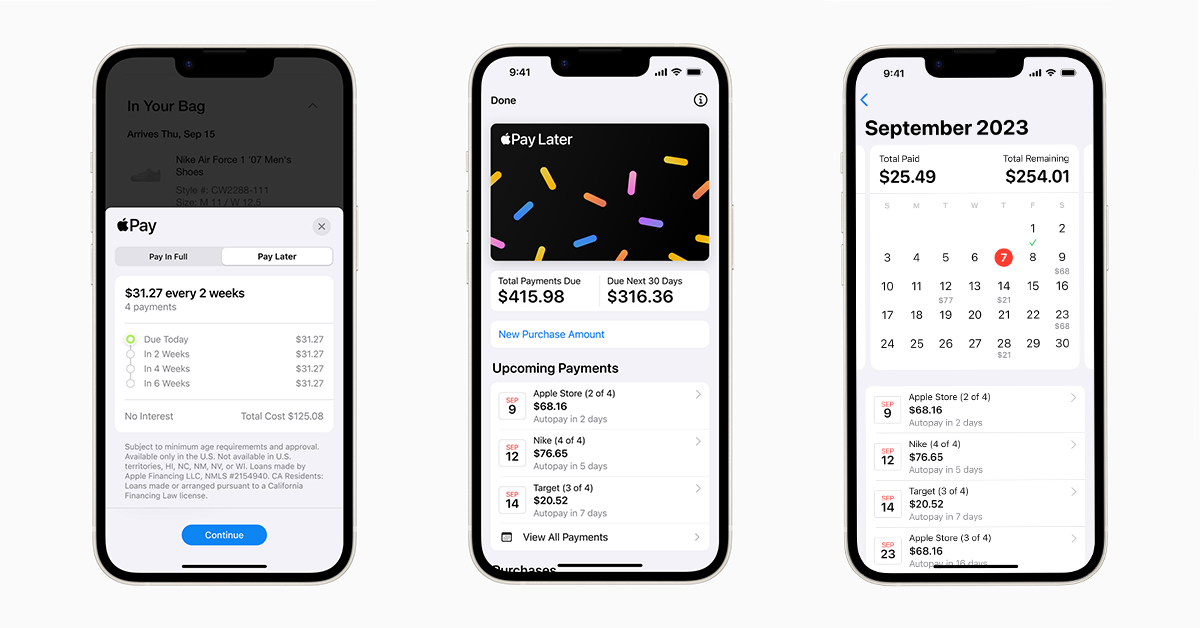

The option to purchase now and pay later is currently exclusive to iPhones and iPads, and its availability is not yet accessible to everyone.

Apple is introducing its own version of the buy now, pay later (BNPL) service with the launch of Apple Pay Later. The service will allow users to apply for loans ranging from $50 to $1,000, which can be repaid through four installments over six weeks without any interest or fees. Apple Pay Later is integrated within the Apple Wallet and aims to provide an alternative to paying the full price of a product upfront. Initially, the service was intended to launch with iOS 16 but was delayed due to technical issues. Users can apply for loans within the Wallet app with no impact on their credit, although the loan and payment history may be reported to credit bureaus, which may impact their credit. Pay Later will be available for in-app and online purchases on iOS 16.4 and iPadOS 16.4, and invites for early access will be sent randomly to select users in the US. Users will receive notifications when payments are due and can manage their loans within the Wallet app.

In 2019, Apple and Goldman Sachs collaborated to introduce a credit card; however, the new Apple Pay Later service is the first time Apple is exclusively managing the financial aspect. Apple Financing LLC, a new subsidiary created by Apple, is in charge of credit assessment and lending for the Pay Later program. While Mastercard Installments is responsible for facilitating the BNPL program, Apple partnered with them to enable Apple Pay Later, and Goldman Sachs issues the Mastercard payment credentials. Starting in the fall, Apple Financing LLC will report Pay Later loans to US credit bureaus.

Although Apple emphasizes “financial health,” its entry into the BNPL space through Apple Pay Later has raised concerns, as similar systems like Klarna, Afterpay, and Affirm have faced criticism in the past for potentially harming customers. The Consumer Financial Protection Bureau (CFPB) identified several risks of consumer harm associated with BNPL systems last year, including inconsistent consumer protections, data harvesting, and the potential for debt accumulation, as BNPL services are designed to encourage consumers to purchase and borrow more. The CFPB launched an investigation into multiple BNPL companies in 2021 and is currently assessing their impact on consumers.